How is Inflation Impacting Insurance?

The inflation rate in Canada reached an all time high in 2022. Inflation is now affecting every single one of our customers. Gas, groceries, the cost of living have all increased drastically. Inflation is impacting us all. People who own homes or cottages or are looking to build a home. Our commercial customers are also being impacted whether you are a small business or a large manufacturer or municipality. So how exactly is it impacting the insurance world?

Insurance companies typically increase the replacement cost limit on the buildings you own at your renewal to keep pace with inflation. However, during the course of the pandemic those increase in limits have not kept pace with inflation. This is causing a problem in the insurance world. The replacement cost, from an insurance perspective is the cost to replace your home if there was ever a total loss. This could include cost to remove debris, redo a foundation and the cost to build a new home or building. The replacement cost is different from a regular construction project and is not tied to the market value of your property.

Personal Property Insurance Inflation

When we look at the personal property space (homes or cottages), it is clear that the rebuild limit associated with many insurance policies is likely less than what is should be. So what does this mean for you, the client? Insurance companies use programs to determine the replacement cost of your home. They use factors like the square footage, age of the home and location. The program provides a value for the amount it would cost to rebuild your home if it was involved in a claim. The premium you pay is also correlated to that value. If you have been with the same insurance provider for several years this replacement cost amount may be significantly less than what it should be. The cost of materials, labour and other factors have drastically increased the cost to rebuild a home. If your property insurance coverage only protects for actual cash value and not guaranteed replacement cost, you may be in trouble in a claim.

Actual Cash Value vs. Guaranteed Replacement Cost

If your policy is an actual cash value policy the building limit you have on your policy is extremely important and you will want to make sure it is an adequate amount to rebuild your home if it is involved in a total loss. Actual cash value policies pay the depreciated value the policy is insured for. If that amount is not adequate you will need to pay the difference yourself. Most insurance companies offer guaranteed replacement cost on home and property insurance. You should check with your broker to see if this is available on your policy. Guaranteed replacement cost means your insurance company will pay the full replacement cost to get you back in to a home or cottage that is the same as what you had prior to your loss, regardless of cost.

Commercial Property Insurance Inflation

Commercial property insurance has some similarities to personal property insurance. The cost of materials used to rebuild a building have increased at a rate higher than inflation. On top of that, there are labour shortages in many industries and construction is one of them. This means the jobs may take longer to complete and can be more expensive. With commercial insurance having an accurate and up-to-date building valuation is very important. Outdated valuations could leave you under insured if the rebuild cost exceeds your existing coverage amount.

Being under insured on a commercial building can be costly thanks to the co-insurance clause.

What is Co-Insurance?

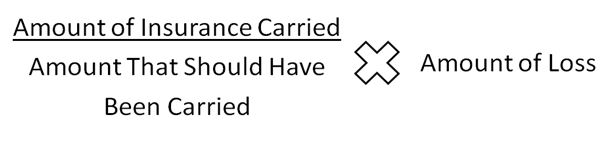

Co-insurance is when a portion of the payment made against a claim is paid by the insured. With regards to property insurance co-insurance is an agreement between the insured and insurance company to maintain coverage up to a stated percentage of the property value. For instance if you are in a 90% co insurance situation and insure a building for $700,000 but the rebuild cost or amount of insurance you should have carried is $900,000 you would only be awarded $544,444 in the event of a total loss claim. Had the building been insured up to the full amount of $900,000 you would have been fully covered. The amount of insurance carried, divided by the amount of insurance that should have been carried, times the amount of the loss is equal to the amount you will be paid out as an insured when the co-insurance clause is included.

Co-insurance can be quite confusing and commercial property insurance policies typically include a co-insurance clause which is why it is important to have the expertise of a broker on your side. They can walk you through the process and ensure your building value is adequate and up-to-date. Speak to one of our commercial insurance brokers today to make sure you, your property and your business are protected properly!

You Might Want to Read

July 23, 2024

Does my car insurance cover a cracked windshield?

June 5, 2024

Welcome All Time Insurance Brokers to the McDougall Insurance Team!

November 2, 2023

Welcome M.B. Kouri Insurance Brokers to the McDougall Insurance Team!