History of Insurance

Wikipedia describes Insurance as “the equitable transfer of the risk of a loss, from one entity to another in exchange for payment.”. And that is true, whether you are looking at property insurance, auto insurance or even business insurance. Your insurance company takes on some of the risk of a loss, in exchange for you giving them money.

But how was this concept first imagined? Who was it who thought of insurance?

Origins

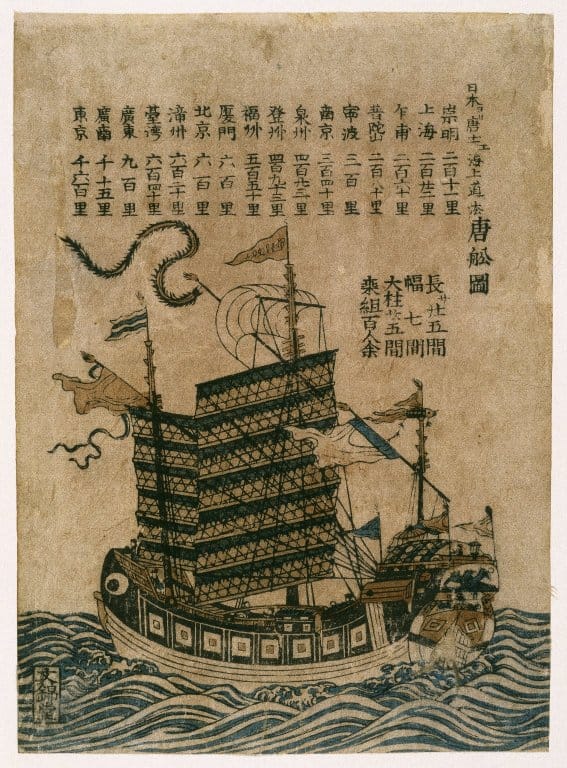

Well, not actually pirates. Chinese merchants. During the 3rd and 2nd Millenia BC, Chinese Merchants would spread their wares across multiple vessels, to reduce the risk of losing their goods if a ship sunk. At approximately the same time, The Babylonians were building insurance into their loan contracts, where someone taking out a loan could spend a little extra money to have their debt removed if their products were stolen.

As time went by insurance became increasingly complex, with insurance on people being introduced by Achaemenian monarchs in the 6th Century BC, and real health and life insurance being created by the Greeks in the 5th Century BC, with the introduction of “Benevolent Societies”, who would take care of you if you fell ill, or your family if you died, in exchange for payment.

Unfortunately for the insurance brokers of ancient Greece, this is where progression in the field of insurance largely slowed down, until further changes began to be implemented in the middle ages.

The Middle Ages

Insurance contracts began to take shape in the 14th century in Italy, while maritime insurance became increasingly popular for sailors and merchants. However, it remained a minor footnote in the great novel of humanity until a major disaster proved the need for insurance (which is ironic, as disasters tend to not be insured now). What disaster? The great fire of London.

The Great Fire was a catastrophe for London, that consumed the great city in a blaze that lasted 4 days, destroying over 13,000 homes and numerous other buildings and churches. The sheer destruction is hard to fathom – imagine if 80% of New York City was demolished tomorrow.

It was a disaster for those who lost their homes and loved ones in the blaze, and sparked dramatic reform to help people recover from such drastic events. Nicholas Barbon, along with several other associates, founded the “Insurance Office for Houses” in 1681 as a response to the fire. The Insurance Office was the first real fire insurance company, and offered residents policies on their homes, which would cover them in the event of a fire.

This founding prompted the establishment of several subsequent insurance companies, and brought insurance to the masses. Insurance companies were a common sight in Europe in the 18th century, and they spread to North America with the European settlers.

Mutual companies, who sold policies only to their owners and did not aim to make a profit, became increasingly popular in smaller farming communities who used them subsidize losses. This trend continued and until the 20th century, nearly all insurance was local in nature.

However the 20th century marked rapid development of large companies as communications infrastructure made it possible to cover a much broader geography, and mutual companies began to be phased out (although many still exist today, we even do business with some of them!). Now we live in the age of the mega company, with insurance organizations continuing to merge to gain additional economies of scale, although there is still a host of smaller insurance companies ready to compete for your business.

And that, is the history of insurance.

We may not have been there from the beginning, but with a history that stretches back to 1946, McDougall Insurance uses it’s experience to help you. We know Insurance like the back of our hand – make us work for you! Give us a call at 1-800-361-0971 or get an online quote today!

You Might Want to Read

March 21, 2025

Car safety certificate Ontario – Safety Inspection | Ultimate Guide

March 20, 2025

Is My Garage, Shed or Any Detached Structure Covered On My Home Insurance Policy?

March 20, 2025

Car Tag Tracking Systems in Ontario – Ultimate Guide